What Is Cost Per Lead, and How Can You Use It To Improve Your Marketing?

It seems like all you have to do is think about marketing and you’ll start seeing endless ads for companies promising foolproof lead generation. How do you know which tactics work and who’s just blowing smoke?

The name of the game in marketing is fine-tuning your application of proven strategies through testing and reviews. To that end, one of the most critical metrics is cost per lead.

We’ve been at this marketing thing for a while now and want to share what you can do to improve your CPL. Check out what’s working currently.

Key Takeaways:

- Cost per lead is a marketing metric or a pricing model, depending on whether you’re using inbound or outbound methods.

- Use CPL with other metrics and models, such as cost per mille, cost per click, and cost per action.

- The BANT process can help you find higher-quality leads.

- Inbound marketing tactics remain the best strategy for lowering your cost per lead.

The Modern Definition of Cost Per Lead

Cost per lead either refers to a marketing metric for evaluating the success of inbound campaigns or a pricing model for paid outbound campaigns. As an evaluation metric, cost per lead calculates what you spent on average to generate a new prospective customer.

When CPL is a pricing model, a marketing firm runs a campaign (such as email, online ads, or outbound calls) and charges you for how many leads they deliver. B2B companies and high-ticket sellers needing to coax buyers through a sales funnel can benefit most from these campaigns.

Where some teams trip themselves up is not understanding what a quality lead really is. The old days have passed of randomly calling people or knocking on doors and viewing everyone you meet as a lead.

The hyper-personalization of digital experiences means you need to distinguish between mere contacts and qualified leads who truly need your service. For that reason, your cost for different leads has differing returns on investment.

How To Determine Cost Per Lead as a Metric

Even if you hate math, you don’t need to be afraid of figuring out your cost per lead. Simply divide your advertising and marketing expenses by the number of leads and you have your figure.

The thing to remember is not to miss any related expenses, such as tools for creating and distributing your content. More advanced cost-per-lead metrics also factor in the cost of your time.

Finally, remember to restrict your calculation to a specific timeframe to get good results. You’ll want to compare your cost per lead for all of your marketing against that of particular campaigns to determine ROI.

An Example of Calculating Cost Per Lead

Here’s a quick example of calculating your cost per lead for a campaign:

Suppose you spend $5,000 on a pay-per-click campaign that runs for two months and generates 100 leads. Divide $5,000 by 100 and you get that your leads cost you $50 each for that campaign.

Why You Need To Keep Calculating Cost Per Lead

Your cost per lead provides an excellent way to compare the value each marketing campaign delivers. From there, you can determine where to focus your marketing spend.

This metric can be handy if you’re a marketing team lead looking to secure capital for a budget. Executives will be looking for clear evidence that you’re supplying the sales team with quality leads to contact because premium leads usually cost more.

However, you typically need more than the numbers on cost per lead to accurately measure your campaigns. Use cost per mille, cost per click, and cost per action to dig deeper into lead quality and cost.

A Refresher on BANT for Qualifying Your Leads

One downfall with these metrics is that you can focus too much on quantity and not on quality. One hot lead ready to buy today is worth more than 100 who “need to think about it” or “will be back.”

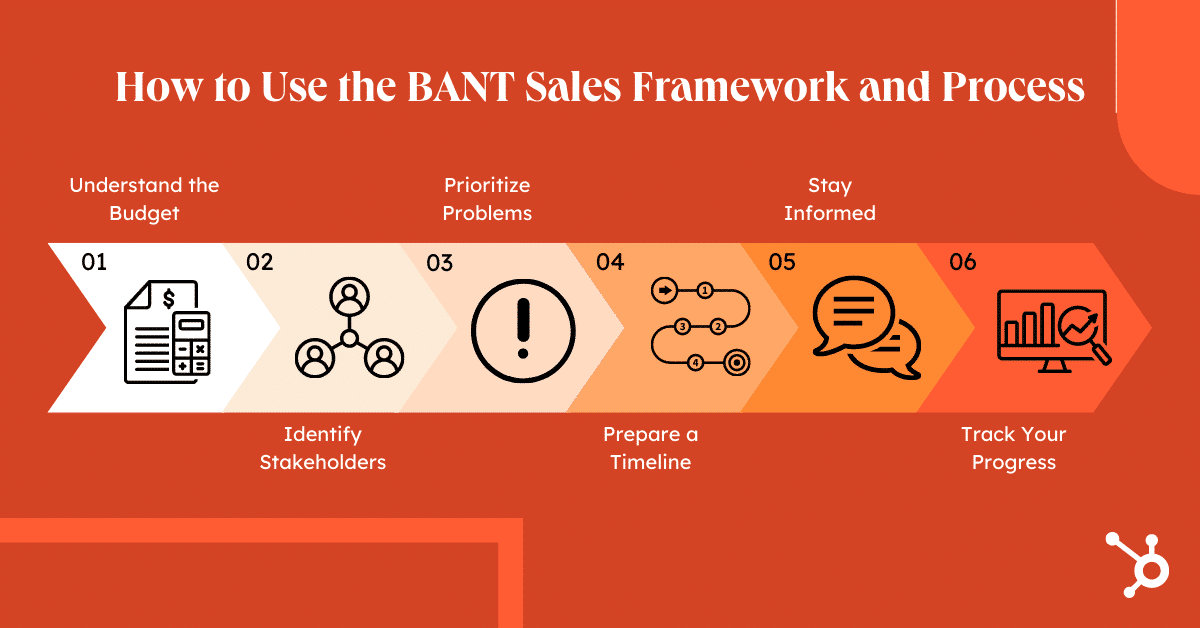

The BANT system helps you score your leads to add actionable data to your cost per lead calculations. BANT stands for:

- Budget: What the prospect is willing to spend on the solution

- Authority: Whether your contact makes the final decision

- Need: Whether the prospect truly needs your product

- Timeframe: The amount of time the prospect has to make a decision

You can also add another qualifier to the equation: an S for the next Step. A lead with a real project and a defined course of action is a top prospect.

Sales teams have had difficulty finding out this information early enough in the sales process. When marketing lends a hand by finding ways to segment and qualify leads, the lead becomes more valuable: The cost per lead is essentially less because more convert.

Tips for Reducing Your Cost Per Lead

No matter how low your cost per lead is, you certainly want to get it lower if you can. Use the following ideas to make your campaigns more effective:

- Personalize and segment: If the ad or content you’re sharing doesn’t match the audience, you’ll get little engagement. Customers expect to have experiences that fit their needs and personality.

- Test campaigns: You shouldn’t just do what looks and feels good to you. A/B test content and ads to discover what performs best.

- Refine your keywords: You should regularly check whether your keywords are working well and drop poor performers. Targeting more long-tail keywords can lead you to a more motivated audience.

- Focus your site according to visitor behavior: Your current customers and visitors are telling you what kind of leads you can most easily attract. Study who converts and when and create campaigns around those behaviors.

All successful marketing comes down to tracking, testing, and executing. Watching your cost per lead in connection with your campaigns helps you make the right decisions.

Why Inbound Marketing Generates the Lowest Cost Per Lead

Lead demand generation may be a necessary part of your marketing. Still, inbound marketing with excellent content delivers the lowest cost per lead with long-term ROI.

Blogging, email, social media, and search have consistently driven the lowest cost per lead over a decade. Outbound tactics can cost you almost double the investment.

Buyers have more control than ever and are tuning out traditional advertising and push-based messages. People want to engage with brands organically.

As Rand Fishkin, co-founder of Moz, said: “The best way to sell something: don’t sell anything. Earn the awareness, respect, and trust of those who might buy.”

The current proliferation of content means buyers expect high-value information to be readily available. At the same time, that information should be short, scannable, and social to connect genuinely with the target audience.

All of these reasons make top-tier inbound marketing through unique content the ideal way to lower the cost per lead.

How MIG Can Help You Minimize Your Cost Per Lead

You can reduce your lead costs with remarkable content, but you have to find the time to execute your plan. You also need a system for measuring success.

Talk to us at Marketing Insider Group about how our content services can help you fill in the gaps. We’ll demonstrate how an awesome content strategy can help you start lowering your cost per lead.

Thanks for this infographic, it’s great! I am intrigued by the statistic, that the B2B sales cycle has increased by 22% in the past five years. This rings true! I do wonder if it’s all down to more decision makers in the buying process though. Could it also be partially due to the ongoing homogenization of firms within highly fragmented industries? (In other words, lots of companies offering the same service with little differentiation can cause selection paralysis among buyers.)

Thanks Jesse, I think the challenges are more complex, orgranizations are more complex, and solution ecosystems are more complex. So it’s really the whole ecosystem that has driven the increase in time and people involved.

Unsurprising the lead costs are decreasing.

I encourage CMOs at big advertisers and directors and chief executives at middle market ones to consider this a modern-day version of the computer hardware / consumer electronics industry.

Only today the focus is on software applications.

Economics dictates that supply of lead sources / technology increases faster than quantity demanded, price is driven downwards.

This is why you see plenty of advertisers pleased to see the lead acquisition costs go down, however, who is to say – when that advertiser calculates costs per lead and follow-up the close / transact new business ratio is enough to net a suitable profit margin?

In layman’s terms – more and more digital avenues keep bringing leads to the market place, thus driving their products (internet leads) down.

A smarter, leaner solution exists for in-house sales lead generation. Especially in specialized B2B products / services at higher price points marketed to sophisticated end-users.

Because of my experience having done lead gen and retention marketing for Merck & Company, GlaxoSmithKline, Novo Nordisk, Novartis, New York Life, John Hancock USA / Manulife and AXA Equitable Life Insurance plus over four years in consumer behavior research at Nielsen Publishing, medium-sized advertisers usually go about consulting me after they:

1. grow disappointed with their investments in a marketing service / agency to drive sales leads / demand

and then

2. a marketing VP realizes how challenging / time consuming the decision to save money and manage sales lead / demand generation becomes before long.

As the info-graphic above points out, the bigger the advertiser, the more money they want to throw at the problem.

Many times, I assess the competitive landscape and lead acquisition cost and piece together a way to generate sales leads without writing bigger checks or abusing the client / advertiser’s Mastercard.

It has less to do with creative ideas and brand awareness and more so with smarter, leaner lead gen programs the client / advertiser controls themselves.

Corey Weiner, Advertiser-side demand / lead generation.

@weinercorey (888) 913 – 1419