Growth Isn’t Everything: 7 Lessons Learned from 5 Failed Companies

So you want to grow your business. I get that. You probably wouldn’t be here if expansion wasn’t on your mind. But while strategies to help you increase your customer base and boost revenue are – on the surface – a good thing, growth alone isn’t enough to support and sustain a company if the right conditions aren’t met.

Unfortunately, it’s not uncommon for businesses that excited about growth to accept – or even create – challenges that they’re not equipped to handle.

This might mean:

- Accepting new clients, even though you lack the resources to meet their needs.

- Launching a product before it’s ready for market.

- Releasing a product that can’t be produced sustainably.

- Launching into a fragile market.

- Taking on a loan without knowing how you’re going to pay it back.

- Employing more staff than you immediately require (and can realistically afford to pay).

- Acquiring facilities that are larger (and more expensive) than you need.

- Expanding into unfamiliar territories.

- Failing to account for and control overhead costs that increase disproportionately in relation to growth.

The results, in most cases, are cash flow shortages and/or long-term damage to your brand and customer relations. It can also cause yourself and your employees unnecessary stress and potentially result in layoffs. In other words, premature growth can be bad for your staff, bad for your customers, and bad for business.

Is any of this sounding familiar? Then stick with me. We’re going to look at a few examples of companies that have already lived and learned from these mistakes, as well as establish some frameworks that will help prevent you from falling into the same traps.

Crumbs Bake Shop

Crumbs Bake Shop launched in 2003. In 2010 they were included as part of Inc.’s “500 fastest growing companies” list. In 2011, they were acquired by a holding company for $66 million. The company then went public, with a share price of $13.

Just three years later, in June of 2014, Crumbs’ share price had fallen to a paltry $0.15. Ouch. So what went wrong?

One key factor in both Crumbs’ success and their subsequent fall from glory was their short-sighted focus on a single, trending product: cupcakes.

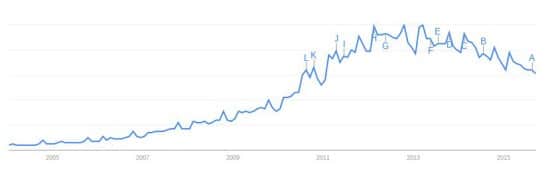

This is the Google Trends data for cupcakes for the last ten years:

Cupcakes are a very recent trend – one that took off exponentially, and is now in steady decline. Crumbs’ mistake, therefore, was to focus on an expansion that was geared around selling more cupcakes in more locations – and little else.

This worked, to a point. But cupcakes (expensive cupcakes at that) have a limited appeal. They’re a treat, not an everyday necessity, and as we can see above, the cupcake’s massive popularity is, in essence, a fashion – and fashions come and go.

Crumbs also chose to invest heavily in costly retail space. One of their outlets, located near Chicago, covered a massive 3,300 sq. ft. – easily the size of a 4-bedroom home.

What can we learn from them?

Work to expand your product range, as well as your reach

Few people buy a cupcake every day. To account for this, Crumbs could have expanded their offering to include items that customers would be more likely to purchase on a daily basis – sandwiches for instance, and of course, coffee (changes to their menu that I think they may now have made – please feel free to correct me if I’m wrong!).

That said, they shouldn’t have added coffee and sandwiches to the menu for the sake of adding coffee and sandwiches to the menu. Crumbs’ “hook” was that they sold awesome cupcakes in an innovative selection of flavors – a standard they’d need to make sure to maintain with any other products they decided to sell.

Focus on ecommerce and delivery, as well as retail expansion

Today, Crumbs has stores in Washington, New Jersey, California, Connecticut, and Massachusetts, as well as a bunch of outlets in New York.

Despite this, they only offer delivery within New York, and (at least currently) there’s no way to place an order online.

The launch of a simple ecommerce shop and delivery service could have enabled Crumbs to expand their offering without the cost of acquiring, renovating, and maintaining numerous retail outlets.

Zynga

2007 saw the launch of social gaming company Zynga, along with their initial release, Texas Hold’Em Poker. Within two years Zynga had become Facebook’s most successful app developer (you’ve probably know them for their success launching one of Facebook’s most popular games ever, Farmville).

Unfortunately, this level of success wasn’t to last, and in 2013, Zynga began to shut down some of their games. This was followed by an announcement that they would be laying off 18 percent of their staff (about 520 employees) and closing their offices in New York City, Los Angeles, and Dallas.

In 2014, they announced a further 15% of cuts to their staff – another 314 employees.

The company is still operating today, although I doubt that’s much consolation to the employees they were forced to let go. To their credit, though, Zynga has never shied away from the fact that their rapid growth was to blame.

What can we learn from them?

Rapid growth is no substitute for self-sufficiency

Zynga’s success is entrenched firmly in Facebook, and, consequently, controlled by it. If we think of Zynga, we think of Facebook, but Zynga has no stake in the social platform. If Facebook closed tomorrow, I think we can safely assume that Zynga would be in a whole lot of trouble.

This overdependence on Facebook has already caused Zynga problems. Facebook previously perceived Zynga’s methods of customer acquisition to be spam, resulting in the social network placing restrictions on the rate at which Zynga is allowed to acquire users.

Zynga was able to grow so quickly because of Facebook’s platform and its audience – a move that they’re now paying for through an overreliance on that same platform.

If Zynga had slowed down and taken the time to push the brand as an independent entity, their story (past, present, and future) might be very different.

Spending money doesn’t always result in making money

In March 2012, Zynga made two very large purchases that, in hindsight, likely played an instrumental part in the company’s layoffs and closures: they paid $228 million for their San Francisco headquarters and $180 million for OMGPOP, the makers of Draw Something, a mobile app which, following Zynga’s acquisition, quickly declined in popularity.

While every decision we make in business is a risk, we can, and should take calculated risks. Unfortunately,Zynga was so hungry for growth that they became reckless with their spending. While we do often need to spend money in order to make money, we shouldn’t spend so much money that getting something wrong puts our company, and our employees, in jeopardy.

It might not sound exciting, but your odds of enjoying long-term success will be much more in your favor if you, within reason, only spend what you can afford.

KIND Snacks

KIND Snacks is a New York based company specializing in healthy snacks. Sales reached close to $120 million in 2012, and today their products can be found in around 80,000 stores across the country. But, like most companies, the path to their success wasn’t always smooth sailing.

In its early years, Kind’s founder Daniel Lubetzky struggled to pay himself a modest $24,000 salary. Lubetzky has admitted that, in the beginning the company, he “put too much emphasis on expansion and taking on big orders that were difficult to fulfill.” He “wanted to grow very fast.”

In 2008, VMG Partners invested in the firm, helping to supercharge the company’s success, in part by increasing Kind’s sampling budget from just $800 to a massive $800,000.

Today, Kind employs a full-time team of field marketers who help to spread awareness of the brand by arranging in-store and office samples, as well as event sponsorships and gift bag contributions.

What can we learn from them?

Strategies that drive growth don’t always have an immediate or visible ROI

Looking back, Lubetzky says he wishes he “had understood the benefits of product sampling. In the early days, sampling was a missing piece of my strategy because I viewed it as an expense rather than an investment.”

Lubetzky clearly struggled with the idea of giving away something for free when the gesture wouldn’t result in an immediate ROI. He chose instead to invest in tactics that were more easily measured. The business took off only after Lubetzky increased the company’s sampling budget, demonstrating that for Kind, the key to real growth was simple: getting the product into as many people’s hands as possible.

Lubetzky could potentially have benefited from taking the time to research the perks of sampling, and discovered far sooner that this was where the secret to the company’s success lay.

Accept that developing a great product takes time

Another key lesson for Lubetzky was to place the quality of the product above all else, “even if that means missing an immediate opportunity.”

It took Kind two years to develop a dark chocolate and sea salt bar. They could have rushed the product’s development to ensure it hit shelves as soon as possible, but Lubetzky refused to compromise on the product’s taste or the quality of its ingredients. He said, “we probably could have launched it in six months, but we did not betray our values.”

If Kind had rushed the bar’s development, they would have risked launching a substandard product that didn’t reflect the rest of the range or the brand’s ethos. They would have let down their existing customers and, potentially, lost new customers that tried the “substandard” product before anything else in the range.

Wise Acre Frozen Treats

The stories above all have a happy ending, or at least, the promise of one to come. Each tale demonstrates that the dark side of accelerated growth doesn’t have to mean doom and gloom, if you can identify where you’re going wrong and implement changes to save the business, before it’s too late.

Sadly, the same can’t be said for Wise Acre Frozen Treats, who, in just two short years, experienced huge success followed by the swift closure of the business.

Their product was a selection of organic frozen popsicles, made using unrefined sweeteners – and there was nothing else like them available at the time. This is often key to a new product’s success, so what could go wrong? Well, as you’ll see, quite a lot…

Wise Acre’s story began in a schoolhouse kitchen in March 2006. After 18 months, they took on their first employee. By 2008, they had a team of 15 and a 3,000-square-foot manufacturing facility. At that point, their products were being distributed to all of the East Coast’s natural food stores, as well as to a number of big supermarket chains.

It was around this time that Wise Acre landed a contract to distribute to the West Coast too, but they never had a chance to fulfil all the initial orders. Before the year was out, the company had gone bankrupt.

Where did they go wrong?

As Wise Acre grew, so did their operating expenses. This is a reality that all companies will have to face; however, the faster you grow, the bigger the chance that you’ll run into problems trying to cover those expenses and fulfill your expanding list of orders.

In order to meet the growing demands of the business, Wise Acre needed to raise more capital.

They managed to secure $300,000 from local bankers and $200,000 from an investment firm – a cool half a million – but that wasn’t enough. To remain solvent, they needed about twice that much money.

In the spring of 2008, they shook hands on a $1 million investment with a local billionaire. Despite only having the investor’s word that the money was on its way, Wise Acre began to spend it. This is understandable – they were in dire need of new equipment, and they had no reason to believe the billionaire wouldn’t come through on his promise.

Just weeks later, the financial crisis hit. Their would-be investors’ stock profile tumbled and the deal fell through. By the end of the year, Wise Acre went bankrupt.

Of course, the real fault didn’t lie with the failed investor, or the economic downturn. The underlying problem was that they simply grew too quickly for their own good.

What can we learn from them?

Wise Acre’s products went from being stocked in just eight stores to hundreds of retail outlets in an incredibly short space of time. Expansion at that speed and at that scale doesn’t come cheap, and rather than wait to raise some of the money needed themselves, they relied entirely on loans and investors.

Now, I’m not saying that you should never seek investment or accept a loan – for many companies this can be essential to their growth or fundamental to getting the business off the ground. However, Wise Acre’s story is a stark reminder that any big financial decision should be approached cautiously, and that it’s a good idea to ensure you’re not relying entirely on outside cash sources (or spending that cash before it’s actually in your hands).

XciteLogic

In 2012, ICT consultancy and management specialists XciteLogic won a Rising Star Award (and enjoyed the accolade of being the only tech company to bag one).

Between 2012 and 2013, the company grew by around 600 percent and increased its staff numbers from just 22 to 105.

The company seemed to be on the way up, but in 2013, XciteLogic entered bankruptcy proceedings, owing nearly $4 million to unsecured creditors, including Apple and HP. Around half of the firm’s staff almost immediately lost their jobs.

Where did they go wrong?

XciteLogic’s unprecedented growth caused the company to become dangerously over-confident, which resulted in strained relationships with creditors, particularly Apple.

The company had also gambled on the development of a (failed) standalone education-based software business.

The overriding problem was that the company grew too fast and simply didn’t have the capital to sustain them or their investments.

What can we learn from them?

I think the key lesson we can take from XciteLogic’s story is to always remember how vulnerable we are.

When things are going well, you feel invincible. Unfortunately, life isn’t a superhero movie and you’re always, always at risk. Losing a big client or an important investor. A failed investment. Growing competition. Or a shift in the economy. All of these things can rapidly put a successful business in grave danger.

Of course, if you understand that your fate could change at any moment, you should be able to minimize these risks by implementing contingency plans that’ll help to keep the company afloat, should the worst happen.

Key Takeaways

Despite vast differences in their circumstances, the businesses above all encountered one key failing: they weren’t prepared for the growth they experienced.

Consider the following takeaways from their examples as you strive to grow your own company:

- Don’t put all your eggs in one basket. When expanding, look at how to expand not just your reach, but your product (or service) range as well. This lesson is even more important if you’ve launched your business off the back of a fashion or trend. Desire for your product or service will wane – all you can do is vary your business model before the decline begins to hit you where it hurts.

- Find ways to minimize the cost of expansion. If you own a store, does expansion have to mean opening more outlets? Could expanding your online reach allow you to boost sales without a substantial increase in operational costs?

- Avoid relying on third party platforms and audiences. Create your own. Dependence on another company’s customer base (think eBay or Amazon) prevents you from building your own brand and puts your company at greater risk should the other company alter its business model (or worse, disappear). If third party platforms help you in getting your business off the ground, fine. If you utilize them for a secondary source of income, that’s fine too. Just don’t rely on them as a substitute for building your own brand and customer base.

- Don’t push a product to market before it’s ready. Product development takes time, and a substandard product will reflect poorly on your company – whether it’s your first or fiftieth addition to the market.

- Don’t rely too heavily on investments and loans. You (and your business) will be far more secure if you ensure your own cash flow is healthy before you begin accepting cash from elsewhere.

- Don’t spend money you don’t have. Markets shift, people change their mind, clients leave, and orders fall through. Don’t spend money that’s “on its way.” Only spend money that has arrived – safe and sound – in your accounts.

- Always be aware of your vulnerabilities. Overconfidence can cause us to make rash decisions that seem wise at the time, yet ultimately, are the cause of our downfall. Rapid growth is not symptomatic of invincibility – if anything, accelerated growth puts your company at considerable risk.

I think the overriding lesson here is to pace yourself. Don’t try to grow your business simply because you equate growth with success. If problems need fixing internally, you should almost always be focusing your efforts and resources on ironing those issues out before you begin pushing for more business.

Pursue growth before you’re really ready and, financial implications aside, you risk disappointing your customers and, consequently, damaging your brand. Premature expansion – though it may make for an entertaining story – is highly unlikely to help you in the long run.

Ultimately, my advice, if you’re thinking about expanding, is to take a step back and carefully assess every element of your company. Detail every problem that needs fixing, and every process that could be improved. Unless you’re already being the best you can be, scaling your business will only magnify existing problems – it will do nothing to solve them.

If you’ve got any other tales of successes or failures when you’ve tried to grow a business, please take a minute to share them by leaving a comment below.

Thanks so much for the Saturday morning read. Scaling a business is a challenge so thanks for your insights. On another note, I might just buy a cupcake today.