How to Create a Marketing Plan for Your Small Business

If you think your small business doesn’t need a marketing plan, think again.

Even if your company is small, today’s technology and consumer behaviors require that you use a variety of channels and tactics to effectively reach customers. A marketing plan for small business owners and teams keeps your strategy on track and focused on the right goals.

Despite this, only 50% of small businesses have an actual marketing plan. To boot, 25% of small business owners say they’re unsure about how to grow their business, 58% spend less than 5 hours on marketing every week, and 86% say they’d rather spend time on other activities rather than marketing.

86 percent!

I get it: marketing isn’t for everyone. But it is absolutely essential if you want to grow your business and attract new customers. If creating and executing a marketing plan is not your forte, you need to have an internal team or partner who can help you do it.

I’d venture to guess that in most cases, small business owners know how important a marketing plan is for small businesses but feel they don’t know how or where to start. In this article, we’re going to walk you through that process.

What follows are 8 steps toward building a marketing plan for your small business that helps you set goals, attract the right customers, increase your website traffic, and earn more revenue for your company.

Let’s get started.

Quick Takeaways:

- Small businesses can assess their current marketing success by conducting a SWOT analysis and competitive analysis.

- An understanding of your target audience and well-defined goals are keys to creating a marketing plan with the right focus.

- The best small business marketing plans utilize a diverse set of channels and tactics.

- Outsourcing is often the best choice for small businesses without large internal marketing teams.

- Measuring results with data-driven metrics is key to your marketing plan’s continued success.

Assess Your Current Situation

Before you start creating your marketing plan, you want to know where you currently stand — both in relation to your own goals and compared to your competitors. There are two processes you can perform to understand each: a SWOT analysis and a competitive analysis.

SWOT stands for strengths, weaknesses, opportunities, and threats. When done correctly, a SWOT analysis is an honest assessment of your current business performance and potential future.

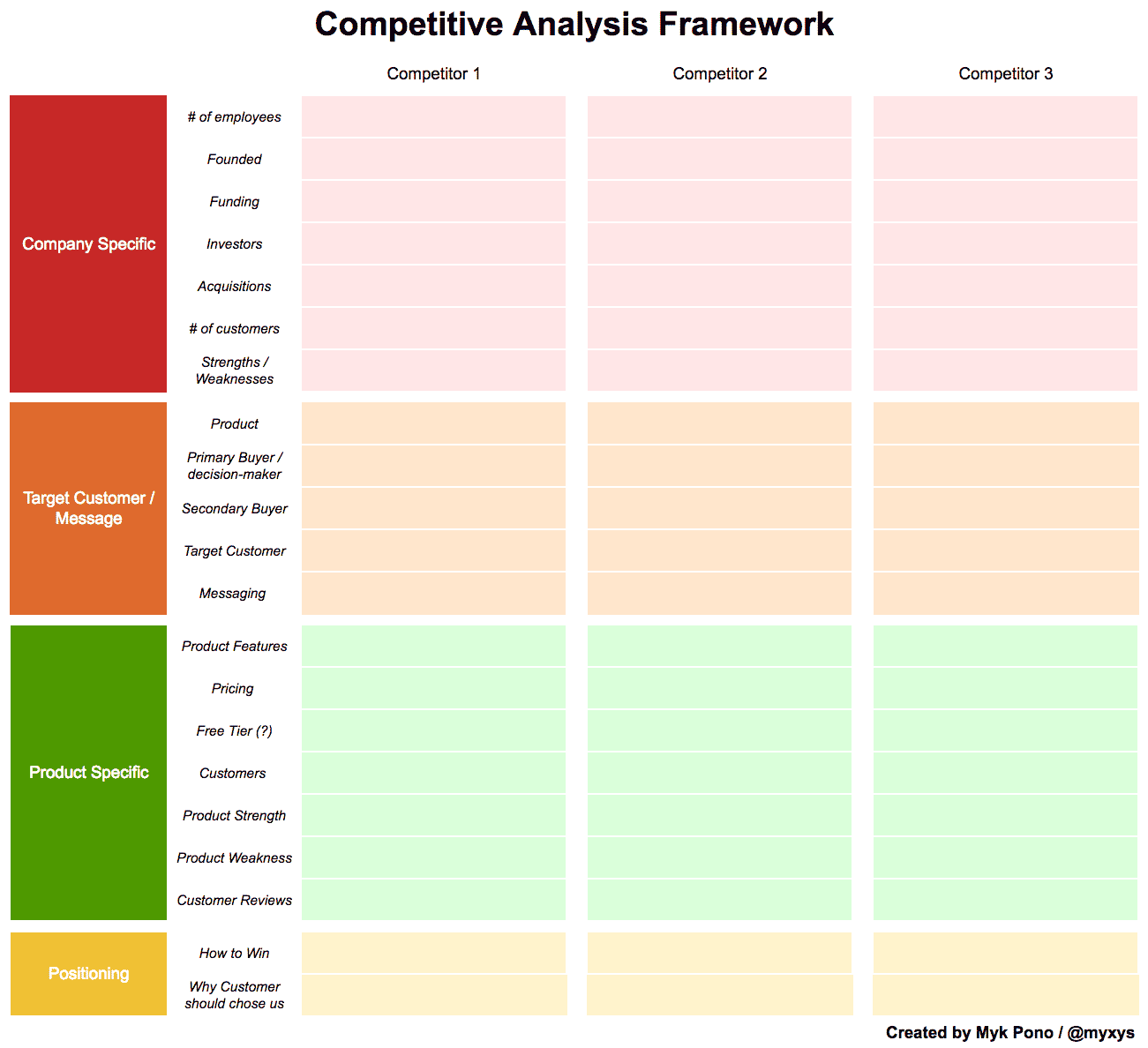

A competitive analysis is the process of researching major competitors to better understand their offerings, performance, and marketing tactics and how yours stack up against them. Performing a competitive analysis helps you identify where gaps exist that you need to fill and where you have opportunities to capitalize on.

Here’s an example of a good, comprehensive competitive analysis framework:

Performing a SWOT and competitive analysis gives you a holistic and realistic picture of your current business situation. It helps you create a marketing plan for your small business that is intentional, focused, and tailored specifically to your needs and objectives.

Identify Your Target Audience

Next up: identifying your target audience. In order to create a successful small business marketing plan, you need to know who you’re creating it for. There are helpful frameworks for this that can help.

First, if you’re a B2B small business, you’ll want to develop your ideal customer profile. An ideal customer profile describes the organizational attributes of the customer who would benefit most from your solutions. It encompasses things like company size, industry, location, customer base, and current technologies in use.

Next, you’ll want to develop your buyer personas. Buyer personas describe the people within those organizations who make decisions about B2B purchases. Here’s how the two fit together:

B2C companies use personas too, although not quite in the same context as B2B companies. Rather than looking at the motivations of people who hold roles within organizations, B2C companies build personas about the people who are buying their products for personal use.

In both cases, however, your personas should be driven not by arbitrary traits but rather by the problems your customer is trying to solve and the goals they’re aiming to achieve by purchasing from your company.

Set Well-Defined Goals

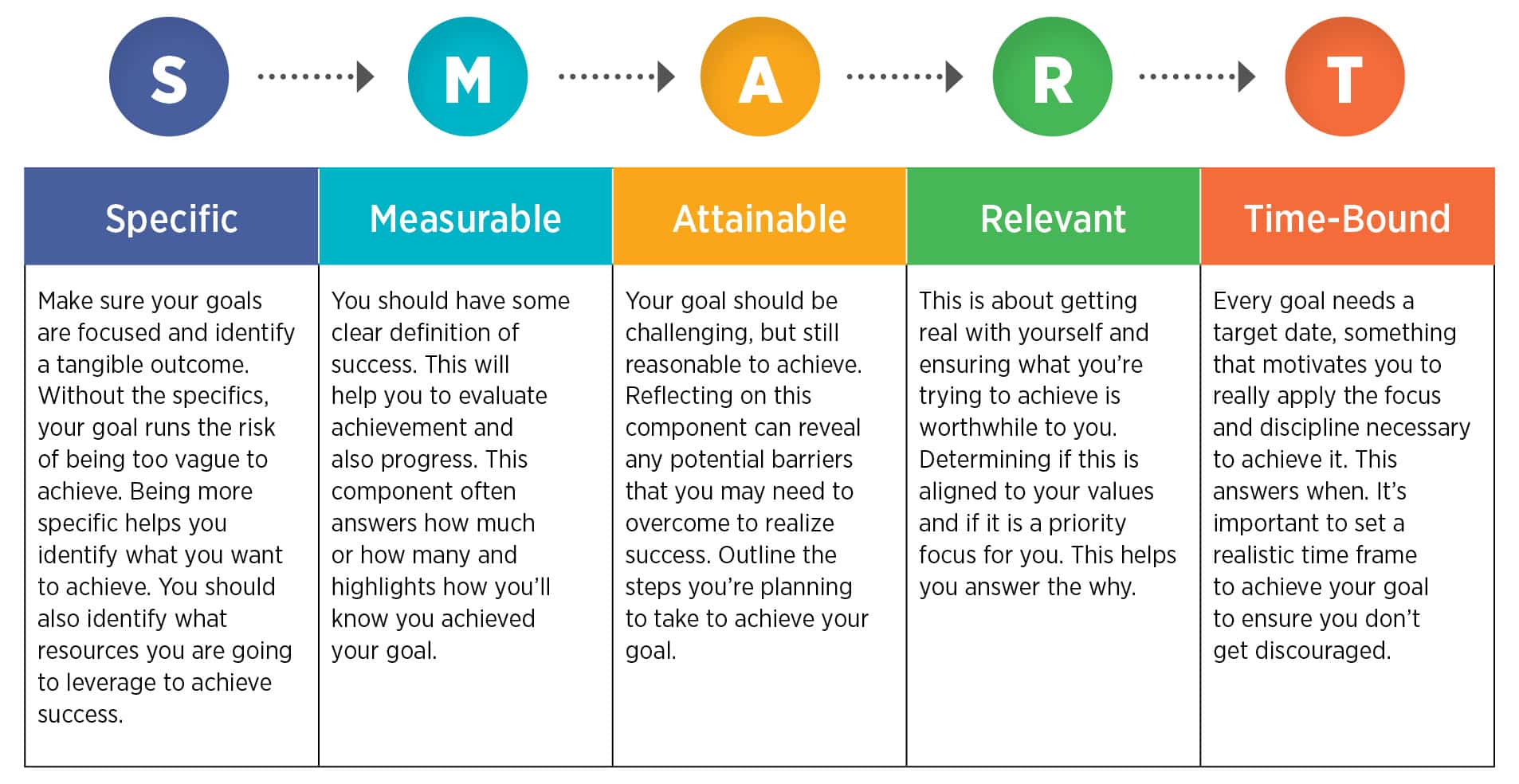

Your goals determine the strategies, tactics, and overall direction of your small business marketing plan, so it’s important to set good ones. But what makes for a good goal, anyway? Mainly, they need to be well-defined and detailed, outlining exactly what you’ll accomplish, in what time frame, and how you’ll measure their success.

You can use the SMART goal framework to set goals that check all of these boxes and more.

Create a Marketing Budget

Setting a budget gives you a realistic handle on how much you can invest in your marketing plan. Many small businesses assume that their smaller budgets automatically mean a less effective plan, but fortunately that’s not the case. Thanks to technology, you can do a lot with even a conservative small-business budget. The key is to know your marketing budget so that you can maximize your resources.

This is a good place to mention content marketing, the most cost-effective and high-ROI strategy of all. Content marketing is 62% more cost-effective than any other approach to marketing while earning 6x the conversion rates. In other words: it needs to be part of your marketing plan. See our guide for building a content marketing strategy to dive deeper into how you can start leveraging content right away.

Decide Which Channels and Tactics to Pursue

The best marketing plans are multichannel and use a variety of tactics to reach customers. The thing is, certain channels and tactics work better for certain types of companies, and no company can (or should) try to do everything. The key is to know what channels and tactics are available to you and choose the ones that best suit your goals.

Let’s go over some examples:

SEO

Optimizing your content for search engines is the surest way to stay visible in today’s technology-driven culture. For small businesses that operate in a certain geographic area, local SEO can be especially important. You also need to know how content and SEO work together.

Content Marketing

We mentioned it already, but I’ll drive it home again: content marketing is essential for every business today. More than ever, consumers are in charge of the buying process. When they look online for brands and solutions, it’s your content that’s doing all the engaging until customers decide to reach out directly.

Social Media

Social media marketing is one of the best ways to make your marketing message appear where customers are already looking: their social feeds. By creating a strong social media presence, optimizing your social profiles, leveraging paid social media ads, and sharing your content on your social platforms, you can be sure your target audience will be more likely to find you.

It’s true that it’s getting harder for brands to stand out in people’s constantly full inboxes. Still, email is overwhelmingly reported to be the most-preferred method of brand communication by consumers across industries. A strong email marketing strategy is a great way to directly engage with your customers frequently and non-intrusively.

PPC

PPC ads on search and social can still be a valuable way to get seen and drive customers to your website. While you can’t depend on them exclusively, you can use them to give your marketing a boost or jumpstart a specific campaign.

Influencer Marketing

Influencers are the new celebrity endorsements. People trust influencers, feel they can relate to them, and buy the products they promote (even when they know they’re getting paid to do it). You don’t even need a huge budget or a connection with major influencers to get started with an influencer marketing program. In fact, studies have shown that micro-influencers with niche followings have better engagement.

Word-of-Mouth Marketing

Here’s the short of it: about 90% of consumers trust recommendations they get from family, friends, and online reviews. Building a community of brand advocates and making reviews of your products and services are extremely effective for driving sales and revenue in both B2B and B2C environments.

Offline Marketing

Offline channels include traditional media channels such as TV, radio, and billboards. It’s easy to assume that offline marketing is no longer relevant, but it continues to have an important place in reaching customers — particularly for small businesses operating in one specific geographic area. Research also shows that creating brand awareness with offline tactics drives better online conversions later on.

Develop Your Marketing Plan

Time to develop your plan. This might seem daunting, so let’s break it down simply. The most important things for your marketing plan to include are:

- What needs to get done

- When it’s going to get done

- Who is going to do it

You already know your target audience, your goals, and your desired channels — now it’s all about putting in one centralized place to drive action. There are tons of great marketing plan templates you can find online and customize to your small business.

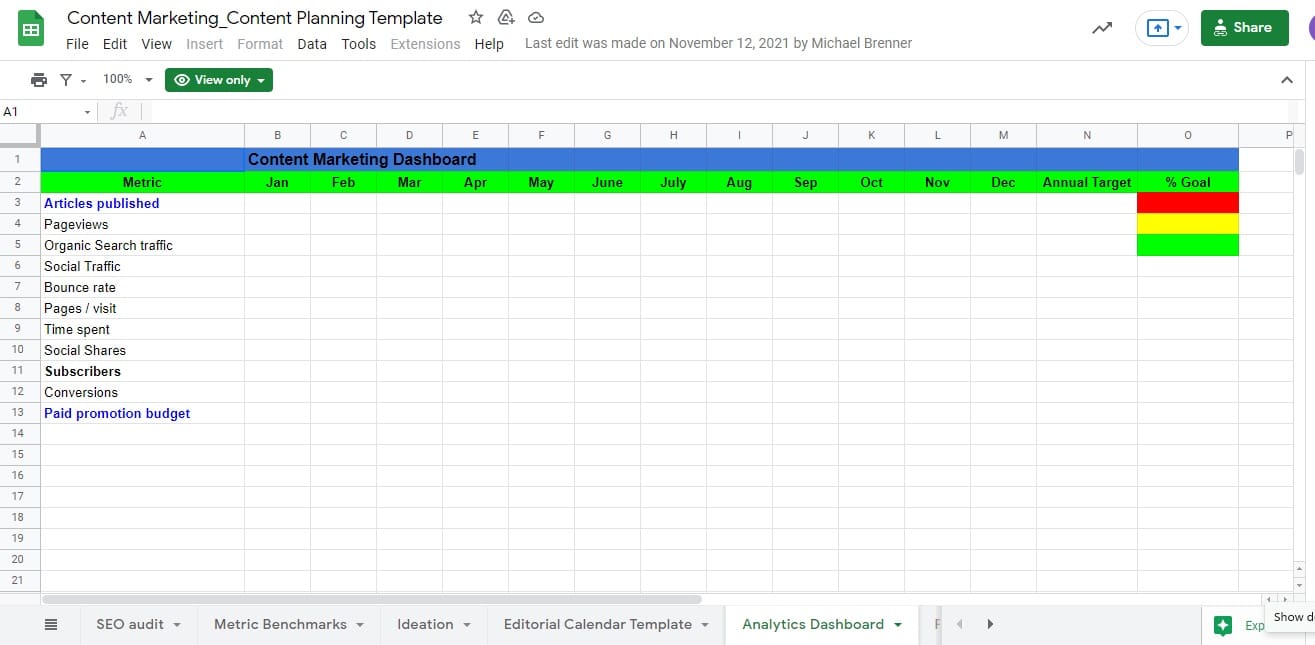

Check out a quick view of the one we use at MIG below, and check out our full list of useful marketing templates for more.

Build Your Team

Who will actually execute your plan? Failing to outline who exactly is responsible for every task included in your marketing plan leads to inevitable gaps, or worse — the blame game. Don’t let it happen to your small business. Identify your team, get them on board, and communicate expectations.

If you don’t have an internal team to execute your plan (many small businesses don’t), outsourcing might be the best option for you. About 70% of businesses outsource their content creation and other marketing activities.

While it’s a financial investment for sure, outsourcing does not have to break the bank, and it often brings in better results than trying to do it on your own. Marketing agencies have the knowledge, expertise, and resources to deliver marketing results while you focus on your core business.

Measure Your Progress

The work’s not over after you put your marketing plan into action. To get the highest ROI from your efforts, it’s critical to frequently measure your progress and make adjustments to improve. Remember those SMART goals you set? They have clear (usually data-driven) metrics included that help you clearly understand whether you’re meeting them or not. Meet with your team on a regular basis to assess progress and identify new opportunities so you’re continuously maximizing your results.

Content Will Win It for You

Content is the single most important thing that differentiates your digital presence from that of the competition, especially if you’re a small business. But here’s the thing: you likely don’t have time to handle content and all of the other priorities that come with running a business. Our team of writers and SEO experts can deliver you optimized, ready-to-publish content every single week for one year (or more!).

To get started, check out our SEO Blog Writing Service or schedule a free 15-minute consultation today!