The Essentials of B2B Influencer Marketing in 2024

B2B influencer marketing is a game-changer for enterprise brands. By partnering with influential thought leaders in your industry, you can reach new audiences, build trust and credibility with current customers and prospects, and drive sales.

Planning and executing a B2B influencer marketing strategy is challenging. There are several moving pieces that require attention and focus. But the most critical factor is how you identify the influencers you decide to collaborate with. If you get this part wrong, your entire program can get derailed with poor performance. In addition, you’ll need individuals who are respected and well-connected in your industry and who align with your company’s values.

Know How B2B Influencers Are Different

Some time ago, MarketingProfs ran an article about influencer marketing which contained an interesting footnote: while 55% of B2C marketers were running an influencer program, the number on the B2B side was only 15%.

With so many B2B products being consideration-heavy purchases, requiring the buy-in of a range of people within an organization, B2B marketers could be making better use of Influencer partnerships to get their products on the awareness, engagement, and purchase path.

B2B influencer marketing is as different from B2C influencer marketing as B2B marketing is from B2C marketing. They might be the same genus but they are different species. To oversimplify, sort a list by number of followers and you pretty much have a target list of B2C influencers. Not so with B2B.

But why are B2B influencers harder to find? As Cox Communication’s marketer Martin Jones told TopRank,

“B2C marketers look for influencers based on popularity and reach, whereas B2B marketers focus more on experts, authority, and thought leadership.”

Experts, authority, and thought leadership. Much subtler characteristics that make the B2B influencer a much more elusive critter.

With B2B influencers, it’s a composition vs reach story. While there certainly is an upper-echelon of recognizable B2B influencers – they speak at shows, they have blogs, they write books, and they do have relatively large followings — the real B2B influencers are those literally connected with the buyer’s journey. And, since people follow people similar to themselves, the audiences they create might be small but could be very powerfully connected. True influencers in the original sense of the word.

So how do B2B influencers become “findable”? We need a sorting hat that would at least create a pool of potential B2B influencers. We developed a reasonable hypothesis-path that goes like this: If B2B trade shows attract potential B2B influencers and, if many shows have unique hashtags, is it not likely that those who comment on show content – even if it was just a random retweet – were self-selecting themselves to be potential influencers?

To test out this hypothesis, we tracked social activity at B2B trade shows over multiple years. Now, with more than 600 shows being tracked across 4 market segments (marketing, technology, media, and automotive), we have some interesting results to share. For much of this information, this is the first time it’s been seen.

1: The number of followers influencers have is significantly more than the average social media user.

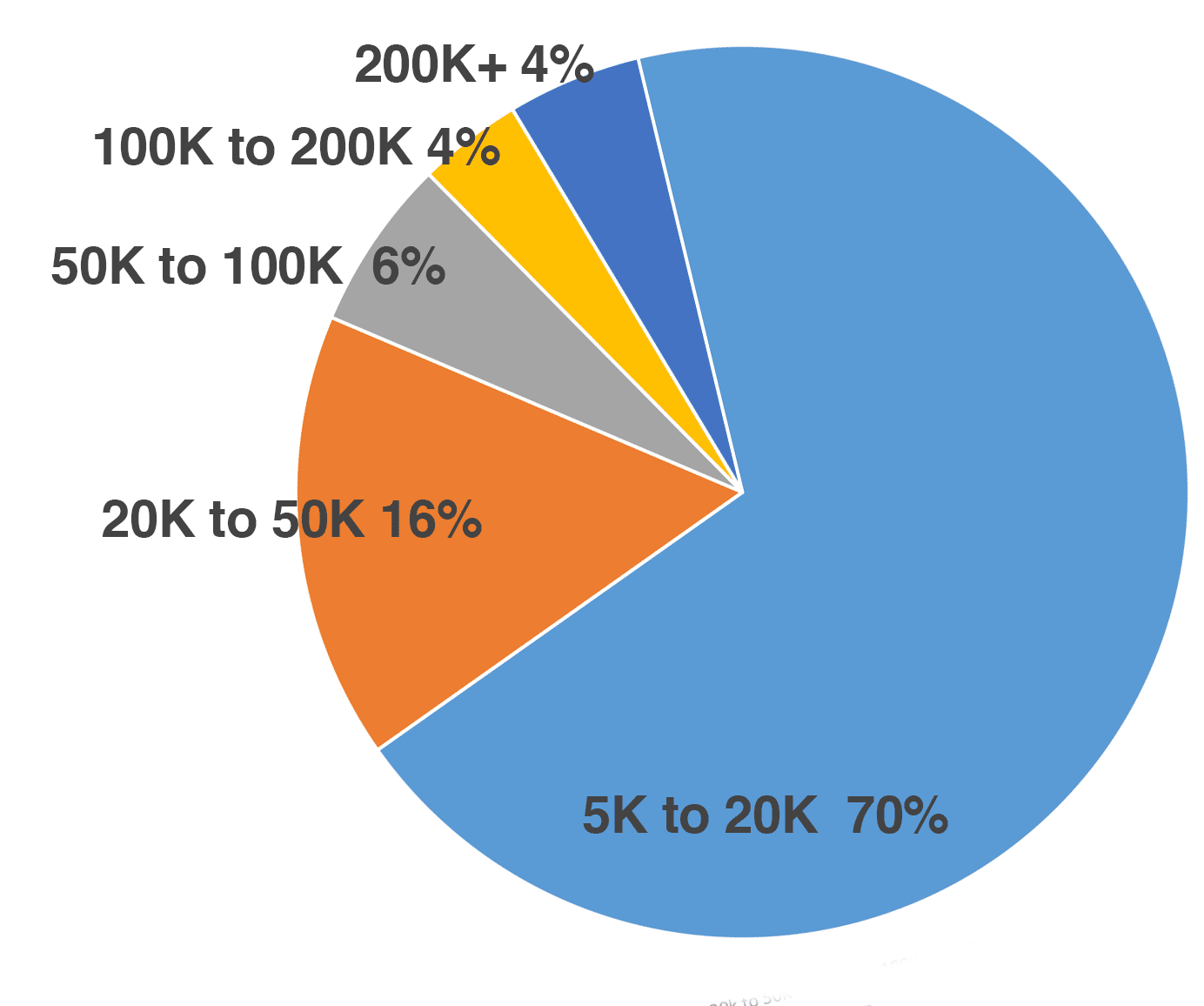

To assess followers, we combined the numbers reported by Twitter (X), Instagram, and YouTube when those numbers were discoverable. Of those with more than 5,000 followers, a full 70% are followed by between 5,000 and 20,000 other accounts. You can see by the pie chart that the vast majority (86%) have between 5K and 50K followers.

What you can’t see in the pie chart is that this data excludes accounts with less than 5K followers. That’s because 93% of all accounts tracked had fewer than 5K followers. That notwithstanding, the average followers per user of this data set is over 4,000 followers, significantly more than the overall X average of 707. Adjusting the X number for growth, it’s still nearly double.

2: Influencers tend to engage across multiple social platforms.

One characteristic of potential influencers is that they engage in multiple social platforms. Of accounts with between 20K and 200K followers, 25% were found to have Instagram. Overall, those in this category had far more Instagram followers than X followers by a ratio of 1.63 to 1. This same group of users (20K to 200K followers) also showed participation in other social media outlets. These include Facebook (57%), LinkedIn (29%), YouTube (29%), Pinterest (12%), and iTunes (5%). Having multiple social outlets is important because it gives a potential influencer various channels to reach the audience.

3: The number of “brands” and “people” that can be called “influencers” is roughly the same.

We excluded the 200k+ category in all this data because eyeballing that list shows that the vast majority of accounts with 200K+ followers are company/brand accounts. It’s pretty easy to differentiate a brand from a person by looking at the account, but much harder to programmatically ascertain whether a social account is a brand or a human (we did it, though). With nearly 1,683 accounts manually reviewed, we can say this: 42% are humans and 47% are brands (margin of error 3%, confidence rate 95%). The remaining were either blacklisted because they were clearly spam or it was not possible to ascertain.

Use Audience Data to Find Influencers

One of the benefits of working in B2B marketing is that it’s not too difficult to find your audience on social media. Most B2B decision makers and technologists self-identify as such in their bios. This makes it easier to find and connect with them. Additionally, most of them are already talking about their specific pain points and needs online.

For example, let’s say you build an audience of 4.5K IT decision-makers (ITDMs). There are two ways to identify who influences this specific audience-using affinity and conversational data.

- Affinity data calculates the percentage of an audience that follows a particular account on social media. For example, if 30% of an audience follows a specific individual, that account has a high affinity with your audience.

- Conversational data looks at the interactions (likes, comments, shares) between an account and your audience. This helps you identify which accounts are already talking to your audience and engaging with them in a meaningful way.

Let’s assume that 55% of the audience follows a certain influencer. This influencer was a 20-year veteran at IBM and even served as the CIO during his tenure. But when you explore the conversational data of the ITDMs, only a very small percentage engage with him.

On the other hand, 13% of the audience follow another influencer who’s been a DevOps engineer for about 10+years. So even though the audience affinity is low, the engagement rate from the audience is off the charts. This is because she is always talking about the latest trends in the IT industry, sharing her point of view on new tech and how they can be applied to solve specific problems.

As you can see, it’s essential to look at both affinity and conversational data when identifying influencers. In this example, the DevOps engineer has a lower affinity but more influence over the ITDM audience.

Identify and Segment B2B Influencers by Type

There are several ways to identify influencers. Unfortunately, spending 15 minutes searching Google isn’t one of them. Over the years, I have experimented with identifying influencers by topic, channel, role, and audience.

Topical Based-Influencers

Topical-based influencers are experts in their field. Their posts are crafted to educate and inform their audiences about the latest news, developments, or trends within their topic of interest. Industry influencers are similar, but there are some differences. A topical influencer is more specialized. They might be futurists, thought leaders or innovators focused on helping others stay ahead of the curve. The last couple of years saw a rise in blockchain and crypto influencers across X and LinkedIn.

Industry influencers focus on macro-level topics like healthcare, finance, or manufacturing. It doesn’t mean they won’t create content or talk about how the metaverse can be used by pharma or within a factory. But they are talking about other topics too.

Topical influencers tend to have a more engaged and passionate following of users who are deeply interested in the subject matter. For companies or brands looking to promote their products or services within a specific industry, partnering with a topical-based influencer can be an extremely effective marketing strategy.

Channel-Based Influencers

Channel-based influencers specialize in building an audience and authority within a specific platform like TikTok. They have a solid understanding of the platforms, capabilities, and algorithms. As social media platforms become less relevant, they will become early adopters of up-and-coming apps and networks. They will have already tested and tried new platforms, so their followers don’t have to. This is valuable because it helps save time for people who want to be on the cutting edge but don’t have the time or ability to do all the research.

While it’s smart to partner and collaborates with channel influencers, you will find that their influence is too narrow to impact the larger digital ecosystem. In addition, their focus is on one platform instead of many. So if you’re looking for an influencer to help you reach a new audience or promote your brand across multiple channels, a channel-based influencer might not be the best fit.

Functional-Based Influencers

Functional-based influencers are respected individuals within their field or industry, and they often have a large following across many social platforms. They use their platform to educate, inform, and entertain their audience. Many of them are also thought leaders who are respected for their knowledge and experience.

There are several different types of role-based influencers, including:

- CEOs & Founders

- Industry Analysts

- Influential technologists (engineers, developers, data scientists)

Functional-based influencers can be very effective because they are subject matter experts, and many have cross-channel influence. They can help you reach new audiences and promote your brand across multiple channels.

There is another way to identify influencers, but it starts with building a target audience first.

Final Thoughts

As we move into 2024, the digital marketing landscape will continue to change and evolve. And as a result, the way we identify and connect with influencers will need to change. If you want to connect with influencers successfully, it’s essential to understand the different types and the best practices to identify them.

When it comes to audience data and research, you need to keep a few key things in mind. First, research is vital to determine which type of influencer would best fit your business. Second, research will also help you choose the ideal platform for your influencer marketing strategy. And lastly, research will help you understand how to measure the success of your campaign so that you can optimize and improve your results over time.

No matter what, always remember that the most important thing is to focus on quality over quantity. It’s better to have a smaller group of highly influential people promoting your brand than a large group of people with little influence.