How to Generate Leads Using Facebook (Without Ads)

In order to be of substantial use to businesses, Facebook has been making it easier for marketers and business owners to generate leads. With more than 50 million business pages, Facebook understands it is important to provide value for business users as well as for the over 1.4 billion consumer pages. It is up to us to take advantage of all the value.

If you believe Facebook lead generation is limited to lead ads, you’re missing out on a big slice of the pie. While lead ads may help to push some customers further along your sales funnel, they are not the only approach you should take for generating leads with Facebook.

Some users won’t bother interacting with an ad, even the more subtle strain of advertising found on Facebook. Also, you’ll miss out on generating higher quality leads with all the inbound strategies you can leverage with your Facebook business page.

If you want to get to the heart of your lead gen power with your Facebook marketing, consider using these techniques. Then, thanks to Facebook Insights, you can easily see for yourself how effective your inbound lead generation tactics are for yourself.

Use Facebook Forms

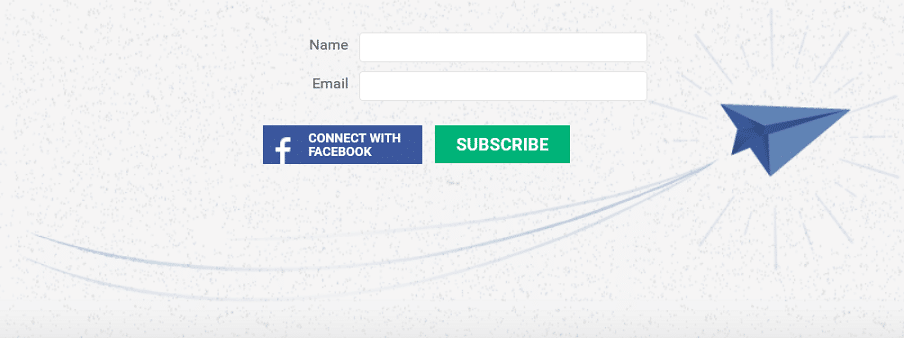

Let’s start out by getting right to the point. You can easily transform your Facebook page into the ‘social’ landing page of the century by using a form. The advantage of a Facebook contact, newsletter subscribe, or other customized form is that it makes it easier for your potential customers to communicate with you as they don’t have to leave your Facebook page.

There are plenty of resources online for creating forms like Wufoo, JotForm and Formstack. Once your form is created, you can embed it into your Facebook page and it will show up as a new tab on your Facebook page. You can also use Facebooks iFrame application to create custom forms.

Get the Post Anatomy Right

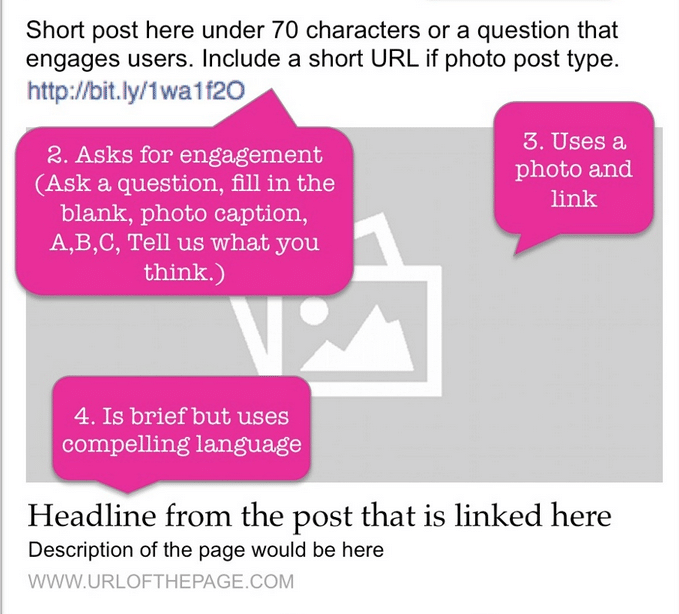

Posting a link to your recent blog post to direct Facebook fans to your website and then eventually to your landing page is classic social media lead generation. In order to make it work, keep your Facebook posts visually appealing. Use an image instead of text-only and boost user engagement by 2.3 times. Just make sure you include a clear link back to your website in the caption.

Hubspot has identified the key features of the perfect Facebook post. Step number one is to have a clear goal, then make it short, visual, and well-linked. Bonus points for being provocative or inspirational.

Live video – employee or client interviews, events, behind-the-scenes footage – can help make your Facebook posts even more magnetic. Facebook users spend 3 times more of their social media viewing time glued to live video content over traditional videos. The better quality posts you use, the more users you’ll attract back to your website, the more likes and shares, and the more Facebook will recognize your content as popular and valuable.

Make Your Lead Magnet Interactive

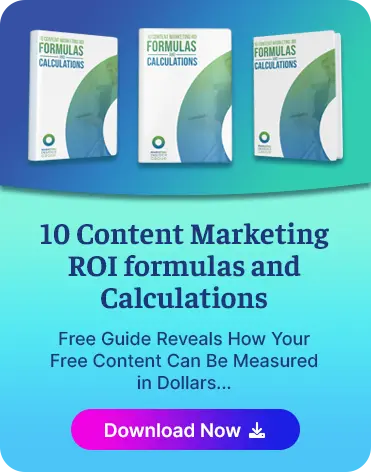

Providing links back to your landing pages where your Facebook fans can sign up to download an ebook, sign up for your newsletter, or access your coupon code is a direct and effective way to generate leads through Facebook. While these are excellent tactics that should be a part of your strategy, for capturing high quality leads, consider offering your brand’s fanbase hosted webinars.

A webinar is an online event. This means you can create a custom event page on Facebook. As you invite users to the page and they sign up, you will be able to create a buzz, put out alerts, and continually build up interest. Your event posts will stand out, drawing even more attention to your Facebook presence and motivating more users to either sign up now, or to keep your brand in mind for later because you are sending the message that you have value to offer.

Tip for webinar success – don’t offer webinars randomly, but rather use a set cadence such as once every quarter, twice a year, every other month. As you promote each webinar, some users who are interested but not convinced to attend one event, will know they can register for the next one x weeks later. You can even use this predictability to your advantage. Create a lead generation form for people to sign up for a reminder for the next webinar that will be launched on your chosen date.

Then, of course, don’t forget to repurpose your webinar content into blog posts and other content – which you can share on your Facebook page to generate more leads.

Change Your Facebook CTA

You probably already have your CTA button – ‘Contact Us’ or ‘Sign Up’ on your Facebook page. This is a great tool that helps to generate leads easily. The only problem is, taking a set it and forget it approach can backfire. Your call to action can become a timeless part of your Facebook page that people stop noticing if you don’t work to make it noticeable.

A lot of brands make this mistake – using a basic logo or branded image, setting the CTA to ‘Contact Us’ and then moving on to focus on posts, not the actual page. A general rule of digital marketing is that the more static something is, the more it becomes a part of your brand’s background noise. While this may work for some parts of your online presence, any place you have a CTA you want there to be some sort of ‘pop’ or energy to break the easily ignorable stillness.

Try changing your button from time to time. Facebook makes it easy to track how well your CTA is doing. Pay attention to how effective one button is over another, as well as the impact of a new button.

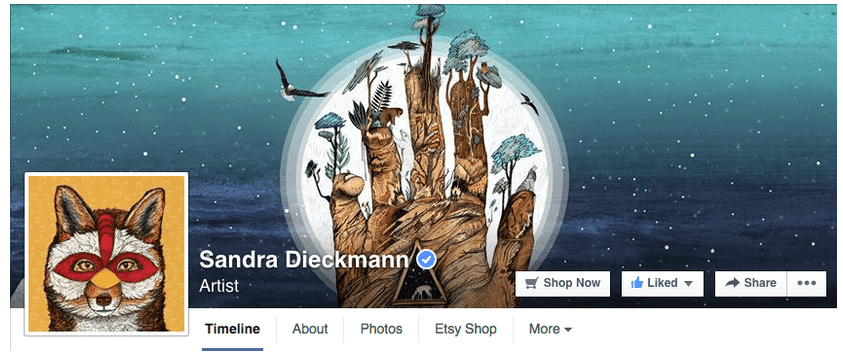

Switch it up to suit your evolving marketing campaigns. Change your Facebook cover image as well for an even more attention grabbing effect. For example, when you are leading up to your webinar, switch to the ‘Sign Up’ button and change your cover photo to reflect the event. Launching a new product? Try the ‘Shop Now’ button with a relevant image.

Here is a great example of getting the most out of this marketing space. Artist Sandra Dieckmannuses her cover to showcase her different art work. She changes the cover image regularly, keeping the page fresh, attractive and interesting.

Lead Generation Goes Way Beyond Lead Ads

Use different lead generation techniques with Facebook. Play around with what works and track your click rates. And, keep evolving your strategy. There’s so much you can do to increase the number and quality of leads you capture from this platform. Just running Facebook ad campaigns may be a useful ‘piece’ of the entire strategy but it is through leveraging all the features you can use, from custom forms and rotating CTAs to value-packed posts and lead magnets, that you will discover the true metal of your Facebook business page.

Thanks, timely information Michael.