Why Your Customer Acquisition Strategy Should Be Content-Driven

Customer acquisition is the lifeblood of any business. It’s the driving force behind marketing strategy and overall business growth.

It’s also extremely competitive and more expensive than ever — customer acquisition cost (CAC) has increased more than 60% in just the past six years. Sounds daunting, right?

It’s definitely a challenge in today’s oversaturated digital marketplace, where every company(?) has websites, blogs, paid ads, social media, and more. But those same digital channels offer a huge opportunity to attract new customers acquisition with content — and not just any content.

We’re talking high-quality, user-focused, SEO optimized, unique, innovative content that grabs attention and converts web visitors into paying customers.

The thing is, pretty much every company knows that digital content is important. But far fewer of them are staying laser-focused on creating quality content that actually performs rather than the crap most companies spit out.

We are proving every single day with our own clients that getting smart about content helps you acquire more customers more quickly, more affordably, and faster than your competition.

Ready to learn how to do it? Let’s get started.

Quick Takeaways:

- Great content drives customer acquisition by building brand trust, an important motivator of purchase decisions.

- You can optimize your content strategy for customer acquisition by creating content for every stage of the buyer journey.

- Brands can capitalize on existing content by continually optimizing their best performing posts and webpages.

- Gated content like high-value lead magnets drives acquisition by capturing contact information.

- Social proof is another important creator of brand trust and assures customers your brand will deliver on its promises.

The Connection Between Customer Acquisition and Content

Like savvy companies leveraging digital opportunities to find and convert customers, consumers are smart when it comes to choosing brands and making purchases. Traditional marketing tactics of the past — catchy taglines, salesy language and the like — are not enough anymore to capture their interest.

This dilemma? It’s why content has become so important to customer acquisition.

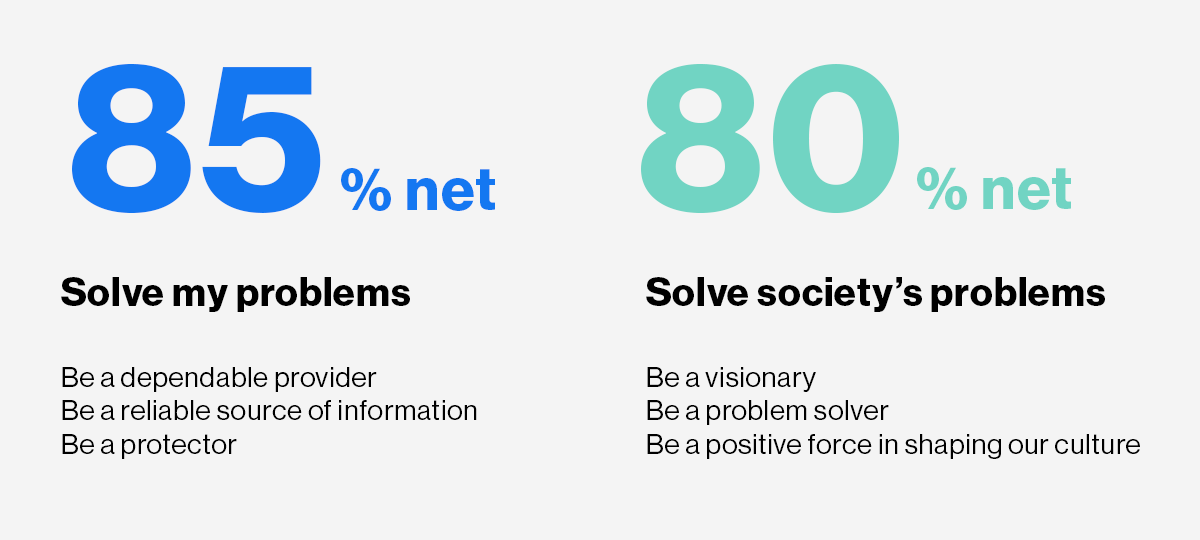

Consumers are not just looking for the brand with the best marketing slogan of the moment — they’re looking for brands they can trust. Research has found that 81% of consumers cite brand trust as an important factor in their buying decisions. They rated it above any other company factor or attribute outside of direct product quality and value.

The research proves that being a helpful provider of thought leadership content will win you new customers.

Image Source: Edeleman

To boot, the same study found that 76% of consumers pay attention to ads from brands they trust, versus only 48% for brands they don’t trust.

Where do consumers go to establish the trust they value so highly? Your content. By creating and publishing consistent, high-quality content, you establish credibility and brand authority, build your brand’s personality, and provide value for consumers that tells them your brand can deliver what they need.

Why Content is the Key to Customer Acquisition

Content vs Ads

Most people think marketing is just ads. It’s the annoying stuff that interrupts the content you are trying to consume. Watching the superbowl? Nope, we’re gonna serve up 3 ads first. Reading an article of Forbes? Nope we’re gonna pop-up an ad for something you are not interested in. Ads don’t work. And everyone knows it. But that’s what most people think marketing is.

We use the term “content marketing” to refer to the kind of content that actually helps people. It’s what marketing is supposed to be. And marketing’s main goal is to acquire new customers.

Content marketing works because it is written by people for people. It works because it is intended to help you get educated, to share experience, to drive you forward. Content marketing works better at acquiring new customers because it’s goal is to help, not sell.

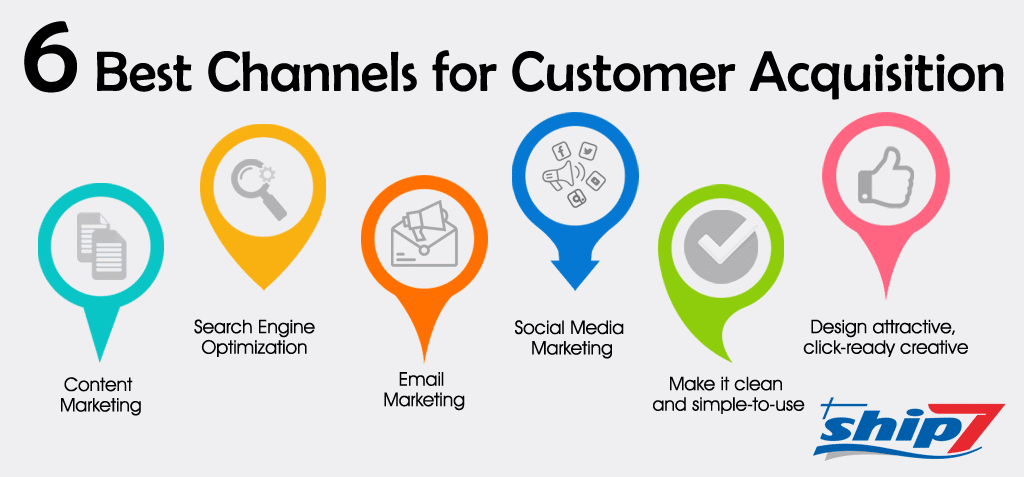

Content for Search, Email and Social

Want to rank for search engines? Don’t try using ChatGPT for that! In order to rank for search engines, you simply need to answer the search intent of the keywords and questions your buyers are asking.

When you create content that ranks, it also works well in email and social media. You see, search still matters! Alot.

Content ROI

Ok, now we’re really getting into it. I said the main reason to use content marketing for customer acquisition is because it works. There is the famous marketing stat that content marketing leads cost 62% less than traditional marketing. And that’s because content marketing is better at attracting and converting new customers for less money.

At SAP, our content marketing platform delivered $7 in revenue for every dollar we spent. That’s a 7X ROI. Guess what the ROI was of the rest of marketing? Around 1x. In other words, marketing barely paid for itself. (In fairness, we influenced hundred of millions of dollars of pipeline that didn’t get “credited” to marketing)

Content + Paid

There’s a lot of talk about AI taking over content marketing. And while we’ve proven that nonsense wrong, it is true that it’s getting harder, not easier, to acquire new customers through organic means. One way to supplement organic content acquisition is through paid.

I’m not talking about banner ads that have 99 problems and a click ain’t one. I’m talking about paid content marketing. We take our best client content and promote around the web. Then we re-target those readers with later stage offers.

Our CPC is 90% less than industry average and our click through rate is 20x higher. Paid content marketing works for customer acquisition as well!

How to Ace Customer Acquisition with Content

Align your Content with the Buyer Journey

You might hear that any traffic is good traffic when it comes to website visitors. To some extent that can be true, especially when your company is new and your main goal is increasing awareness. But when it comes to powering customer acquisition with content, you need to get intentional.

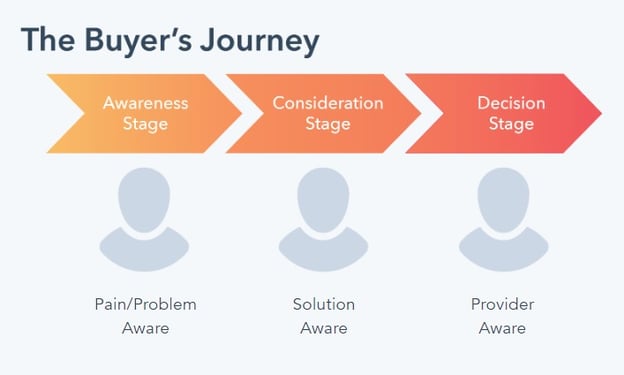

That means matching your content up with your buyer’s journey.

As your buyer moves through the sales funnel, the content that best matches the intent of their visit to your website will change. Someone doing their first Google search on a product or service they need is likely looking for more information about the problem they’re experiencing, meaning content like your top-of-the-funnel blog posts would be really relevant.

Someone later in the stages of the buying process might be looking for confirmation that your brand is indeed the one to choose, and that person might be better convinced by a whitepaper or in-depth case study.

Here’s a great visual to help you think more about the kinds of content that belong in each stage:

Image Source: Hubspot

When you’re thinking about aligning your content with the buyer journey, you always want to think of two things:

- Giving potential buyers the information they need at their current stage

- Including a Call To Action (CTA) or other motivator to pull them into the next stage of the buyer journey

Get Serious About Your Blog

Your blog is the foundation of your content marketing strategy. It’s great to know that you need a blog, and by now most companies do. But it’s not enough to just publish content — even if it’s fairly relevant to your industry — and hope it will perform.

Your blog content must be consistent and customer-focused. Always be extremely intentional with your blog content. Use categories to organize your content in ways that align with your content goals with customer search intent and your buyer journey.

You can start with SEO keyword research and a current content audit, then build from there. For more on the process, check out our guide to choosing blog categories and content themes.

You can set up your blog for success by combining your content optimization tactics with close attention to backend technical details that help your blog perform, including blog visibility on your home page and main navigation, using article page templates, configuring URLs and more.

(Or maybe you need a weekly blog service from us?)

Optimize your Best Performing Content

Optimizing your best content is the low-hanging fruit strategy of enhancing your customer acquisition with content. You’ve already done all the work, and your work is already paying off — the content is performing well and driving traffic to your website.

Now it’s time to take it a step further so it converts that traffic into leads and sales.

Here’s how you can find and optimize your best content:

- Visit tools like Ahrefs or Semrush and search for your domain.

- Click on “organic keywords” to access a list of keywords you rank for and their corresponding URLs

Once you can see which content is ranking high, do a deeper dive using other tools on these platforms or by doing your own research. Be sure they’re as optimized as possible. Mainly, be sure they rank for the right keywords and have tactics in place to capture visitor information (like gated content, CTAs, subscription forms, and more).

One of our favorite tricks is to find articles that used to perform well and update them. This post was originally published in 2018 but we updated it with the latest stats, links and information. Here are some tips to updating your old posts.

Leverage High-Value Gated Content

Gated content, also known as lead magnets, capture visitor information by offering them something extremely high-value in return. Gated content comes in many forms, but it always offers something different and more valuable than what your visitors can access in your free content.

So, for example, if your blog covers why content audits are important, your gated content could be a complete PDF guide to performing a content audit.

Some of the most commonly used (and effective) types of gated content include ebooks, whitepapers, checklists, templates, and how-to videos.

Create Videos

Video is currently the most in-demand type of content by online users across the board, and brands are responding accordingly (86% of companies currently use video as part of their marketing strategy). Cisco predicts that video will account for 82% of all online traffic by next year.

The good news? You don’t need to have expensive video production equipment to produce great videos that can drive customer acquisition.

Companies (and most people around the world) are using smartphones to record and share high-quality video content. Simply creating social media stories is an effective way to make your brand visible to customers. As you get better at video (or can afford more resources), you can expand your strategy.

Other exciting video marketing trends you can try include vlogging, live online events, webinars, and user-generated content (sharing video of customers interacting with your product/brand).

Demonstrate Social Proof

Social media alone isn’t enough to acquire new customers. But it can support your content marketing customer acquisition.

Do you look for reviews and testimonials when you’re buying a product or choosing a brand? So does everyone else! Research shows that 88% of consumers trust online reviews just as much as personal recommendations, and buyers often read dozens of reviews before making a purchase.

You can power your customer acquisition potential by highlighting social proof throughout your content. Some of the best ways to do this are:

- Including reviews and testimonials throughout your website

- Publishing case studies that demonstrate your success with other customers

- Sharing user-generated content (like online reviews and product photos or videos)

https://www.youtube.com/watch?v=PLg6CuIowks

Social proof assures your potential customer that you’ll deliver on your promises. It is often the deciding factor for a customer considering making a purchase. Integrating social proof content into your customer acquisition strategy makes it more likely to convert leads and drive sales.

Grow Your Business with Customer Acquisition Content

If you’re ready to publish content that is always optimized to drive results, Marketing Insider Group has solutions. Our writers can deliver ready-to-publish content every single week for a year (or more!) and our Content Builder Service includes a customized strategy to help you deliver it.

Schedule a quick consultation to get started today!